BTC Price Prediction: Year-End Rally Likely as Institutional Demand Grows

#BTC

- Technical Strength: Price above key MAs with Bollinger Band expansion

- Institutional Tailwinds: ETF volumes and RWA tokenization hitting records

- Cyclical Timing: Historical year-end rallies align with current setup

BTC Price Prediction

BTC Technical Analysis: Bullish Signals Emerge

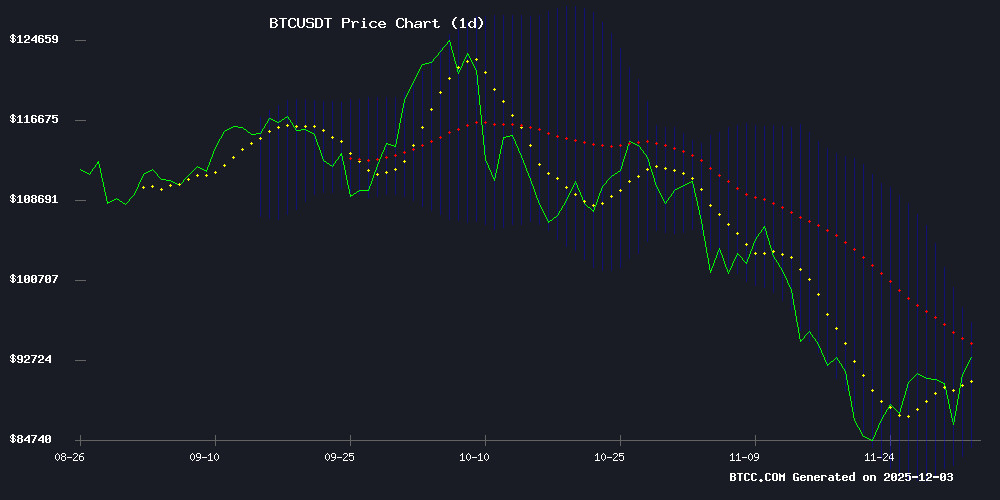

BTC is currently trading at $92,822.16, comfortably above its 20-day moving average of $90,222.31, indicating a bullish trend. The MACD shows a negative value (-2,263.7563), suggesting some short-term bearish momentum, but the price holding above the middle Bollinger Band ($90,222.31) signals underlying strength. According to BTCC financial analyst Emma, 'The upper Bollinger Band at $96,470.74 could act as the next resistance level, while support lies NEAR $83,973.88.'

Market Sentiment: Institutional Activity Fuels Optimism

Positive developments like BlackRock's Bitcoin ETF hitting $3.7B in volume and SPAR adopting crypto payments are driving bullish sentiment. However, concerns linger about dormant BTC awakening during market weakness. Emma notes, 'Institutional adoption is reshaping Bitcoin's cycles—ETF inflows and tokenized RWA growth to $24B highlight structural demand.'

Factors Influencing BTC’s Price

Australian Bitcoin Industry Body Files Complaint Against ABC Over Biased Coverage

The Australian Bitcoin Industry Body (ABIB) has lodged a formal complaint with the Australian Broadcasting Corporation (ABC), accusing the public broadcaster of misrepresenting Bitcoin in a recent article. The disputed piece allegedly framed Bitcoin solely as a tool for money laundering while omitting its documented applications in energy stabilization, humanitarian remittances, and sovereign reserves.

Tensions between Australia's crypto sector and traditional media have escalated as adoption rates surge. The country now outpaces the U.S. with 31% crypto adoption in 2025, up from 28% in 2024, according to a16z's State of Crypto report. ABIB reports frequent member complaints about recurring media bias, particularly from publicly funded institutions bound by accuracy requirements.

The complaint identifies specific policy breaches in ABC's coverage, focusing on one-sided framing that conflates bitcoin with criminal activity. Chief business correspondent Ian Verrender's article allegedly characterized Bitcoin with undefined negative attributes while ignoring legitimate use cases.

BlackRock's Bitcoin ETF Volume Hits $3.7B, Fueling BTC Price Rebound

BlackRock's iShares Bitcoin Trust (IBIT) ETF surged to $3.7 billion in daily trading volume, eclipsing mainstream offerings like Vanguard's S&P 500 ETF (VOO). The institutional demand triggered a 7% Bitcoin price recovery to $93,040, reversing earlier weekly losses.

On-chain data reveals IBIT now holds 3.88% of circulating BTC supply with $66.2 billion in cumulative volume. Despite $65.9 million in December outflows, the ETF's dominance underscores growing Wall Street adoption following Vanguard's decision to permit Bitcoin ETF trading on its platform.

Two Bullish Developments Signal Bitcoin's Resurgence

Bitcoin's recent volatility has given way to stabilization, with two pivotal developments suggesting a potential breakout. Bank of America now recommends allocating 1%–4% of investment portfolios to cryptocurrencies—a watershed moment for institutional adoption. Meanwhile, Vanguard's evolving stance on crypto hints at broader market acceptance.

The endorsement from Bank of America's investment office, effective January 2026, marks a seismic shift in traditional finance's approach to Bitcoin. Merrill Lynch and Merrill Edge clients will gain exposure through Bitcoin ETFs, reinforcing BTC's status as a strategic asset.

Vanguard's reconsideration of crypto restrictions further validates the asset class. Though historically cautious, the firm's 2025 pivot aligns with growing demand for digital asset exposure—a quiet but potent catalyst for market maturation.

Swiss Supermarket Chain SPAR Rolls Out Nationwide Crypto Payments

SPAR Switzerland has activated Bitcoin and cryptocurrency payments at checkout across more than 100 stores, with plans to expand to 300+ locations. The system, powered by DFX.swiss, allows customers to scan an OpenCryptoQR code with supported wallets like Binance Pay, selecting from 100+ cryptocurrencies. Transactions are instantly converted to Swiss francs at the point of sale, shielding merchants from volatility.

The MOVE cuts payment processing fees by roughly two-thirds compared to traditional card networks, according to the company. Notably, the integration eliminates gas fees when using Binance Pay, making it cost-effective for retailers. The rollout follows a successful Lightning Network pilot in Zug, Switzerland's crypto valley.

This marks a significant step toward mainstream crypto adoption, positioning SPAR as the first major European grocer to enable such payments at scale. The development coincides with growing institutional interest in blockchain-based settlement solutions.

Grayscale Challenges Bitcoin's 4-Year Cycle Thesis, Eyes 2026 All-Time High

Grayscale Research has dissented from the prevailing Bitcoin market narrative, rejecting the widely held belief in a four-year price cycle. The asset manager contends that Bitcoin could reach new all-time highs as early as 2026, despite recent volatility.

The October-November pullback saw Bitcoin decline 32% from peak to trough—a correction Grayscale characterizes as typical for bull markets. "Since November 2022's bottom, Bitcoin has experienced nine separate 10%+ drawdowns," analysts noted. "This volatility aligns with historical patterns during appreciation phases."

The report directly challenges the four-year cycle theory rooted in Bitcoin's halving events, which reduce miner rewards quadrennially. While many traders anticipate a 2025 downturn following three years of gains, Grayscale's analysis suggests alternative trajectories may emerge.

Strategy Warns Bitcoin Holdings at Risk Amid Market Downturn

Strategy CEO Phong Le signaled potential Bitcoin sales if equity values fall below crypto holdings. The revelation came during a Bloomberg TV interview where Le emphasized the company's preference to maintain its dividend policy "into perpetuity" without liquidating BTC reserves.

The firm recently raised $1.4 billion through share sales to create a cash buffer. This provides 21-24 months of runway for dividend payments, deliberately avoiding Bitcoin liquidation. "Our objective isn't to monetize BTC holdings during equity slumps," Le stated, acknowledging market anxieties about forced crypto sales.

When pressed on worst-case scenarios, Le admitted the possibility of BTC disposals follows cold arithmetic: "There's the mathematical side that says it WOULD be absolutely the right thing to do." The comments reflect growing tension between corporate treasury strategies and crypto volatility.

Year-End Rally Loading? HSBC Says Conditions Favor Crypto Upside

Cryptocurrency markets show signs of recovery as Bitcoin rebounds from recent volatility, now trading NEAR $91,000 after briefly dipping to $86,000. HSBC strategist Max Kettner interprets the November sell-off as a corrective phase rather than a bearish reversal, suggesting December could spark renewed momentum.

Market sentiment hinges on macroeconomic shifts, with potential Fed rate cuts acting as a catalyst. Bitcoin's price action mirrors this optimism, though the asset remains sensitive to liquidity fluctuations and risk appetite. Kettner notes: 'This dip looks closer to a buy signal than a sell signal.'

Historically, crypto assets lead risk-on rallies when macro conditions improve. Traders now watch for year-end positioning across equities and digital assets—a convergence that could amplify gains.

Institutional Activity Reshapes Bitcoin Cycle as Tokenized RWAs Hit $24B

Bitcoin's market structure shows signs of maturation as institutional participation reaches new heights. Glassnode data reveals $732B in new capital inflows this cycle alongside a 50% reduction in one-year realized volatility—a hallmark of deepening institutional involvement.

Settlement volumes now rival traditional payment networks, with $6.9T processed over 90 days. This places Bitcoin's throughput on par with Visa and Mastercard, even as activity migrates toward ETF and brokerage channels.

The tokenized real-world asset sector has quietly reached a $24B milestone, signaling broader adoption of blockchain infrastructure for traditional finance applications.

Bitcoin’s Bear Market May See Relief Rallies Before Prolonged Downturn

Bitcoin’s recent price action suggests a potential pause in its bearish trajectory. Analysts observe similarities between the current market structure and the January-April decline, noting a recurring 'Channel Up' formation. The cryptocurrency has yet to enter a new bull cycle, but short-term recoveries could emerge before the next leg down.

A key technical indicator—the 1-Day MACD Bullish Cross—mirrors the March rebound pattern. Such counter-trend rallies, while temporary, may offer strategic entry points for traders anticipating further downside. Market consensus remains cautious, with October’s $126,000 peak still defining the broader bearish framework.

Dormant Bitcoin Awakens as Market Struggles Below $90K

Bitcoin’s failure to hold the $90,000 level has reignited fears of prolonged weakness. Leveraged long liquidations and relentless selling pressure have left the market defensive, with each stabilization attempt met by overwhelming sell orders. The price action suggests traders are bracing for deeper losses as volatility intensifies.

Amid the turmoil, an on-chain anomaly has emerged: dormant BTC—coins idle for 3-5 years—are moving again. Maartunn, a prominent chain analyst, notes these awakenings often precede major market pivots. While the implications remain unclear, the reactivation of old wallets adds complexity to an already fragile ecosystem.

Historical patterns suggest such movements correlate with capitulation or accumulation phases. With macroeconomic uncertainty and shifting Fed policy expectations compounding crypto’s woes, these revived coins may signal either impending distribution or the early stages of a broader transition.

S&P 500 Rises as Boeing and Intel Lead Gains; Bitcoin Recovers

Boeing shares surged 10.2% after CFO Jay Malave projected higher 737 and 787 deliveries and robust free cash flow growth for 2026, marking the stock's best performance in the S&P 500. Intel extended its rally amid speculation about potential Apple business, reflecting renewed Optimism in semiconductor demand.

Major U.S. equity indices climbed, with the S&P 500 up 0.3%, the Dow gaining 0.4%, and the Nasdaq advancing 0.6%. Risk assets showed resilience as Bitcoin (BTC) pared recent losses, signaling tentative recovery in crypto markets.

Is BTC a good investment?

Based on current data, BTC presents a compelling investment case:

| Metric | Value | Implication |

|---|---|---|

| Price vs 20MA | +2.9% above | Bullish trend |

| Bollinger Band Position | Upper band at $96,470 | Room for upside |

| MACD Histogram | -2,263 | Short-term caution |

Emma advises: 'DCA during dips below $90k, as institutional adoption (ETFs + RWAs) provides long-term support.'